If it’s not broken, don’t fix it. How do we know it’s not broken if we don’t understand how it works?

If it’s not broken, don’t fix it. How do we know it’s not broken if we don’t understand how it works?

One of my goals with this blog is to share my neophyte understanding of topics I care about in a way that doesn’t require the reader to spend the same amount of time it took me to write it.

I am by no means targeting expert audiences (my articles wouldn’t survive their scrutiny). If I can get a few readers interested in these sometimes obscure or intimidating topics and maybe even compelled to dig deeper on their own, I would have accomplished my personal mission.

This article’s topic would have been the most painful and head-scratching one I had the self-inflicted pleasure to go through so far. Today, we’re talking about Capitalism (bummer), a tacitly accepted economic model that is hard to discuss without becoming political.

Why Capitalism? Because it implicitly dictates many aspects of our lives, but at the same time, most of us only have a limited understanding of it (maybe I’m just projecting my own ignorance and secretly hoping that I wasn’t alone in my cluelessness).

When I started digging on the subject, I fell into a rabbit hole so deep that for a moment, I feared I wouldn’t be able to get out of it. I was even terrorized to start writing about it, paralyzed by the most intense impostor syndrome I have ever felt.

Then, I remembered that I was allowed to be an impostor, and so here we are!

Why should you listen to someone with absolutely no authority on the subject? Because I’d like to believe that we don’t need to be experts to have a candid conversation. Besides, writing is part of my learning process; it helps me consolidate my thoughts. In a way, by writing, I’m not sharing what I know, I’m sharing what I don’t.

A little bit of history

No ideas are born in a vacuum. Context is important.

To understand how Capitalism came to play, it is worth having a quick look at where it’s coming from. For the sake of simplicity, I’ll take shortcuts and make huge assumptions and unreasonable interpretations. Reader’s discretion advised.

Let’s rewind the clock a little bit.

We used to be hunters and gatherers for a very long time. We lived in small tribes, which allowed us to spend our time more efficiently by sharing the burden of food procurement and child care and look after each other’s wellbeing.

At one point, we started getting quite savvy about the habits of certain types of plants and animals.

All this changed about 10,000 years ago when Sapiens began to devote almost all their time and effort to manipulate the lives of a few animal and plant species. — Yuval Noah Harari, Sapiens

It is commonly known as the Agricultural Revolution. In exchange for a less varied diet, more prone to diseases and drought, we could produce calories more predictably.

Cultivating wheat provided much more food per unit of territory, and thereby enabled Homo sapiens to multiply exponentially. — Yuval Noah Harari, Sapiens

While hunting was still an essential source of nutrition, most of our calories were coming from wheat, and because wheat fields cannot move, we became sedentary.

Then something incredible happened: surplus. For the first time, we produced more food than we needed to survive. We could store the surplus, and even better: some of us could eat without working for it. This was the birth of social classes.

Neolithic Revolution

As populations were exponentially increasing around the most fertile areas, cities started to form. Now entirely sedentary and with too many people to feed to go back to hunting and gathering, wheat fields and production surplus had to be protected from thieves and ill-intended neighbors. Armies were born.

Something to remember is that while our species was being successful in terms of growth, the vast majority of the population was engaged in daylong back-breaking activities necessary to cultivate wheat.

But a few did enjoy the benefits. Privileged members of the elite class who didn’t have to work could spend their time more creatively. Art, entertainment, philosophy, science, and ultimately technology (at the service of the elites, of course) emerged. Civilizations were born.

It’s all about growth

Until more recent technological breakthroughs, there always was a limit to how much resources could be produced within a given area. The simplest way to keep growing was to increase its size. To protect their status and grow their power, cities conquered other cities and grew into a nationwide network under the influence of a very exclusive aristocracy. Feudal systems were formed.

When you can’t grow within your borders anymore, grow outside. Or steal from your neighbors. I won’t mention the thousands of years of conquests, empires, and other warfare activities.

There was a point when a power equilibrium was reached in Western Europe, and countries such as England, France, or Portugal stopped trying to steal from each other directly. However, they did realize that technology hadn’t evolved uniformly across the globe, so instead, they started stealing from less advanced civilizations far abroad. In the process, they also realized they could exploit these weaker territories without any accountability. Colonialism was the name of the game.

The first capitalistic enterprises are much older than we may think. Corporations would be formed, borrow money from banks, invest in a ship, buy equipment, and hire a crew. That ship would then be used to bring back home spices, precious metals, and slaves, making a generous profit in the process. Mercantilism was the big business of its time.

However, advances in technology, particularly with the invention of the steam engine, induced a paradigm shift in productivity and subsequent wealth creation. Market power shifted from mercantilist Capitalism (driven by colonialism) to industrial Capitalism. We had finally found a way to produce more wealth without stealing from our neighbors. This was the Industrial Revolution.

Capitalism

Of course, that didn’t stop us from continuing to exploit colonies in the meantime. With the constant evolution in logistics and transportation technologies, these colonies were eventually industrialized and became an important source of cheap labor. Globalization wasn’t inspired by Western civilization; it was pretty much forced upon.

History of globalization

The final step was to abandon protectionism policies and lower import tariffs to promote free trade. Corporations became global entities, and Capitalism had no frontier anymore.

A lot has happened since then (a couple of World Wars and Great Depressions, abandonment of the Gold standard, market deregulation, etc.) but the backbone of Capitalism hasn’t changed much.

Capitalism in a nutshell

After this fascinating and totally unbiased historical introduction, it may be a good time to define what we call Capitalism.

I usually prefer to avoid quoting Wikipedia, but I couldn’t find a more straightforward definition.

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit

This definition illustrates the contrast with feudal systems and other authoritarian regimes where the means of production are controlled by a monarch, usually the sole beneficiary (along with a few close friends) of the wealth produced.

It also states unequivocally that it is primarily motivated by profit and not some humanitarian aspirations.

There have been many forms of Capitalism practiced in different parts of the world, but they usually have the following characteristics in common.

- They allow capital accumulation, which means the State doesn’t have the power to redistribute capital as it sees fit

- They provide competitive markets, with pricing mechanism based on supply and demand (and not defined by the State)

- They recognize private property, voluntary exchange, and voluntary wage labor

In any capitalist economy, markets may be more or less regulated, and taxation more or less progressive, but anybody is entitled to buy and sell anything (as long as it is legal), accumulate resources, and invest one’s capital for the sole purpose of enriching oneself.

The Good

So we know what it is. What is it believed to be good for?

Freedom of choice

“A society that puts equality before freedom will get neither. A society that puts freedom before equality will get a high degree of both.” ― Milton Friedman

Freedom of choice is a fundamental pillar of democracy.

In a free society, people should have the freedom to choose where they live, where they work, and what they buy.

By allowing the private ownership of the means of production, a society frees itself from a State’s monopoly on production, lifting off restrictions in terms of what gets produced and how, and distancing itself from political forces.

Resources are finite, and as long as scarcity exists, there will be competition. If the State had the power to decide how to distribute resources, there would be a risk of favoritism and corruption. Even if the State were elected democratically, there would still be competition between politicians.

Competitive markets independent from the State provide the products, services, and opportunities to choose from and a “fair”, uncorrupted mechanism to compete for scarce resources.

Innovation through competition

Throughout history, many innovations, particularly in sciences and technology, have been driven by some form of competition. For the longest time, that competition was mainly the result of adversity between tribes, cities, nations, and even empires. Competition’s intensity would culminate when the competing parties were at war; no wonder why war is sadly credited as one of the most significant sources of innovation.

Capitalism has offered new battling grounds for corporations to compete with free markets, resulting in a fair amount of innovation and way fewer casualties (ok, maybe debatable).

The constant competition has forced corporations to outsmart each other by improving their products and services and lowering production costs in the process.

Growing demand (particularly during the 20th century) encouraged continuous investment in better machinery and larger factories, which resulted in more affordable products through economy of scale.

More affordable products created even more demand, allowing industries to grow exponentially. These growing industries generated a higher demand for skilled labor. More people were earning more money, resulting in more demand, etc.

In rich countries, this virtuous circle arguably pulled the majority of their population out of poverty.

Corporations with the right mission have the power to improve lives by making commodities more affordable. A good example is the mission of Panasonic, announced in 1932 by its founder, Kounosuke Matsushita, popularly known as the “tap water philosophy”:

Even though water from a tap is a processed product with a price, no one objects if a passerby drinks from a roadside tap.

That is because the supply of water is plentiful and its price is low.

The mission of a manufacturer is to create material abundance by providing goods as plentiful and inexpensive as tap water.

This is how we can banish poverty, bring happiness to people’s lives and make this world into a paradise.

The Bad

Inefficient use of resources

There is a fundamental difference between productivity and efficiency.

Productivity can be seen as output vs. input, and efficiency as how little waste is generated.

We have become extremely good at reducing the cost of producing goods through innovation, technology, and economies of scale (and the exploitation of cheap labor overseas).

Corporations have an economic incentive (profit) to increase their productivity and to minimize waste. But the relationship between waste minimizing and cost efficiency is much more complicated than we would like to think.

Economies of scale are often achieved by buying bigger machines and larger volumes of raw material at a discount price, even if that means that a significant percentage of the resources will be discarded; it can be cheaper to produce more and not sell everything than the other way around. Sadly, it is also often cheaper to dispose of unneeded resources than to recycle them or even give them away (transportation, logistics, depreciation, etc.)

I won’t mention planned obsolescence and the waste generated by consumers in the name of product novelty.

There is also another way to look at efficiency.

We can define resource distribution efficiency by asking the question: assuming that there is enough of a specific resource to fulfill a given population’s needs, is anyone left behind?

In a world where more than 30% of all the food produced ends up thrown away, and where hundreds of millions of people still can’t eat as much as they need, there is clearly a resource distribution efficiency problem. The question becomes: what is causing it?

Systemic inequalities

“Capitalism is the astounding belief that the most wickedest of men will do the most wickedest of things for the greatest good of everyone.” – John Maynard Keynes

While it can be argued that capitalistic economies have lifted billions of people out of poverty, it has created considerable inequalities as well.

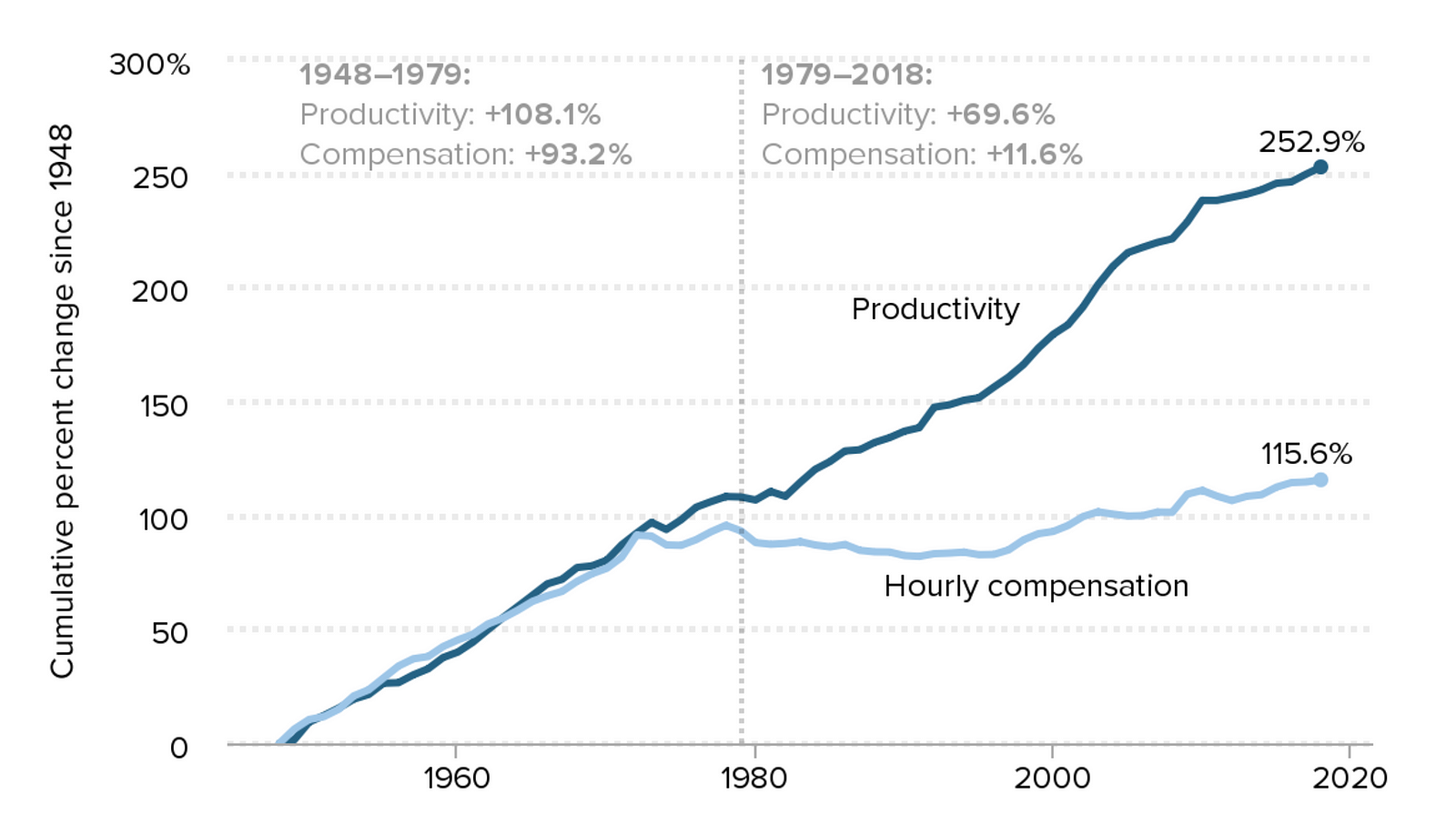

Increases in productivity have translated to improvements in wages up to the late 70s.

From there, the gain in productivity has directly contributed to more profit for corporations – that profit being distributed between the shareholders, as a pro-rata of how many shares of the corporation they own.

To invest in the stock market and buy shares of a corporation, people need disposable income, that is, money remaining after all basic necessities are covered. People with less disposable income have therefore less capital to invest and will generate less interest from their capital.

Economic growth, especially in financial markets, will benefit most those with the largest capital, thus increasing inequalities.

Capitalism ≠ Meritocracy

There is a die-hard belief that success and wealth are meritocratic.

That belief is kept alive by moving stories of self-made men, mostly anomalies of the system, that make us entertain the illusion that anyone willing to work hard can make it. This is of course a severe case of survivorship bias; we only see the few lucky winners but dismiss the innumerable losers entirely.

In reality, the vast majority of the capital is inherited through various forms, such as financial assets or real estate.

Criticism of Capitalism

Another interesting notion is what is commonly called economic rents.

A simple example is Silicon Valley. There are many reasons why technology giants choose to locate their headquarters there – access to a highly qualified workforce, proximity to world-class universities, international connectivity, good weather.

As a result, real estate is prohibitively expensive, and average salaries comparatively higher than anywhere else. Are these houses fundamentally worth more than any other house across the country? Can the difference in pay be explained in any other way than location? Not really. That’s an example of economic rent.

The productivity of the metropolis depends upon public goods that have been provided by the entire nation, such as the rule of law and past investments in the infrastructure for connectivity – Paul Collier, The Future of Capitalism, p.147

But this is rarely factored in when attempting to explain the success of a corporation. Many previous investments from the public sector have likely contributed to that success, but only the capital owners rip the benefits (especially after tax cuts).

Modern slavery

We’ve all heard about sweatshops. They are very real and a black and white example of what modern slavery looks like. But they are an extreme case, often used in the media to show how western countries’ working conditions are far better. However, everything is relative. A Walmart employee paid $10/hour is a more subtle form of slavery called “wage slavery”.

In the absence of regulations, wages are determined by supply and demand. As long as the unemployment rate is not zero, the balance of power will always tilt toward the employers, especially for low-skilled labor.

Not earning enough to put money aside, low-skilled workers don’t have the luxury to renegotiate their working conditions or look for another job that would pay more, restricting upward mobility and reinforcing social stratification.

Capitalism and Inequality

The Ugly

Growth and GDP

GDP has become the de-facto standard to measure economic growth. Many policies are directly motivated by a desire to keep its year-to-year growth rate above a specific number.

While GDP is an indicator of how much value has been produced, it doesn’t take into account wellbeing or inequalities.

Why Capitalism win and how a simple accounting move can defeat it

GDP also sets an absolute metric globally for the perception of value and growth without considering geopolitical realities.

For example, despite the evident misuse of a scarce skill, global GDP rises if a Sudanese doctor moves to Britain and works as a taxi driver – Paul Collier, Future of Capitalism, p.203

As long as GDP stays the prime indicator of economic success, Capitalism will always win economic arguments.

Capitalism ≠ Democracy

While Capitalism has been an essential contributor to the propagation of democracy, it is by no mean a democratic system. Quite the opposite.

For one thing, there aren’t that many people who qualify as capitalists, meaning people who can make a living off the profit from their investments (or interests from the money they lend). They have the power to invest money where they see fit and the luxury to take financial risks to generate even more capital potentially.

Capitalism as a system benefits them the most. But how many are they?

Some estimations go as low as 0.07% of the world population (yes, 1 out of 1400)

et aliiCapitalism and Inequality

Another reason is that there is one thing that deeply affects our lives and is not governed by a democratic process: work.

Adults spend the majority of their awake time at work, and their livelihood usually depends on it.

But corporations are not democracies. They are controlled by their shareholders, who usually have a voting power equivalent to their shares. While some employees may own a few shares of the company they are working for, the vast majority of the shares belong to a very exclusive club of large shareholders.

With most voting power, it is reasonable to assume that consequential decisions will be made with their interests in mind.

They may, for instance, decide to reduce cost by laying off employees to increase the profit margin and pay themselves dividends.

The Market doesn’t solve everything

A common belief from the supporters of Capitalism is that any “worthwhile” problem can be solved by the market without government intervention. In “The Future of Business” (ビジネスの未来), Shu Yamaguchi proposes a simple concept that explains why he doesn’t believe in the almightiness of the Market.

He suggests that any problem can be categorized within two axes; universality and difficulty.

Universality is how common the problem is, which translates to the market’s potential size for a solution.

Difficulty is how hard (in terms of innovation, technology, etc.) or how costly (in terms of resources) the problem is to solve.

Corporations driven by profit and economic growth will focus first on universal and easy to solve problems, then tackle easier but more niche problems, and finally harder but more universal ones (order not relevant here). However, they will rarely give a go at problems that are both very hard to solve and would have a very limited market.

Yamaguchi represents that limitation by something he calls the curve of economic rationality limit (経済合理的性限界曲線). His motion is that a free market will not solve problems that are outside the curve.

Providing shelter to the homeless is a good example. There is literally no economic incentive for a corporation to develop a solution (unless it owns the entire area). And if a corporation were to be mandated by the State to create one, any profit it could make would be paid by the taxpayers, which would evoke ethical concerns.

How do we usually solve that? Charity, which by definition means to relinquish self-interests (and thus profit) out of a sense of obligation or duty, and is the polar opposite of Capitalism.

So if we assume that an advanced society should strive to solve the problems it faces, but that free markets can’t be expected to solve them all, where do we draw the line, and what should be the societal role of these free markets?

Weakened Communities

Capitalism’s success stories have created higher expectations in terms of living standards, and the market has provided career opportunities for the skilled who were willing to move where these opportunities were.

Many extended families ended up geographically scattered, and local communities weakened in the process.

Paul Collier,pp.109–110

This phenomenon has been exacerbated by the globalization of the highly skilled workforce.

Societies are built on mutual obligations. Because there is no such thing as a global society, people still live in nations. Without emotional attachment or feelings of obligation toward their nation and their fellow countrymen, the wealthier will always be opposed to higher taxation, sometimes ready to expatriate to another country with lower taxes.

The end result? A less compassionate society.

Paul Collier,p.52

Where does that leave us?

There is no question that Capitalism and more specifically free markets had a critical role in making our lives better, providing us with food, shelter, and entertainment.

But at what cost? Alarming inequalities, inefficient distribution of resources, scattered families and weakened communities, etc.

Since the early '80s, GDP growth has resulted in an overall increase of wealth, but hasn’t significantly improved average living standards in rich countries; the wealthy has simply become wealthier.

That concentration of wealth is not sustainable in an economic model that expects continuous growth for a very simple reason: resources are finite because our planet is finite.

Today, the GDP growth rate is still the only metric for economic growth that is acknowledged across the board. But how much growth is enough? And what for, if it doesn’t leave everybody better off?

And wealth is just one part of the equation. As obvious as it can sound, people at the top of the food chain have no interest in a fair competitive system based on merit.

Paul Collier,p.93

Because even a democratic process needs money (politicians do need to make a living while they are running for office), inequalities in wealth distribution always translate into inequalities in power distribution, which can put the whole process in jeopardy.

The relationship between Capitalism and democracy looks a little bit like the Stockholm Syndrome; Capitalism has taken democracy hostage, but democracy can’t seem to be able to live without it.

When people feel that both wealth distribution and the democratic process are unfair, they are less willing to participate in the system because they believe it to be rigged (which it kind of is). Or they revolt.

Being disconnected from weakening communities and disfranchised by a democratic system perceived to be unfair, people lose their sense of mutual obligation. The result is a less compassionate society that is the perfect playground for identity politics.

Paul Collier,p.207

And as we’ve seen earlier, there are also many challenges that just cannot be solved by the market, because they are not marketable; they are outside the curve of the economic rationality limit. Capitalism cannot solve them.

Only mutual obligation can.

But that sense of mutual obligation can exist only if we feel strongly connected to our communities. If we can’t put a face on a problem, it just becomes a number, and numbers don’t move us.

“If only one man dies of hunger, that is a tragedy. If millions die, that’s only statistics.” – Joseph Stalin

What I’ve learned

Capitalism has become an umbrella term for a mix of concepts such as free markets, the pursuit of profit, wealth inequalities, etc.

The vagueness of its definition makes any interpretation political, which makes discussions much harder.

It is often said that Capitalism is the best system we’ve got and that we’ve tried other alternatives without much success.

But something to remember is that we didn’t invent Capitalism. Economists and great thinkers of their time didn’t gather in a room to brainstorm for a few weeks and draft a proposal to be submitted to the different governments of the world.

Capitalism just happened as a somewhat logical, maybe even inevitable (in hindsight, of course) consequence of historical events and market forces.

It’s one of the largest social experiments in human history, and it was completely unplanned.

While it has arguably been an engine for innovation and economic growth, and possibly a stepping stone toward a better system, can we truly say that’s the best we can do?

What’s the alternative, you may ask. Capitalists like to point at the Soviet regime as an example of why socialism can’t work and why Capitalism is superior in every way. But was the economic model the only issue? Could there have been other historical and cultural reasons that could have explained its demise? And even if the economic model was the issue, can’t we learn from its successes while not reiterating its failures?

We won’t know if there is a better model until we try something else at large scale, and that can’t happen overnight. Capitalism has built such momentum that it would take an unimaginable amount of energy to replace it. Change can happen only with tiny iterations.

But to decide what these iterations should be, we need to know where we want to go and what would a better system look like.

We may be powerless individually, but I believe that we still have a responsibility to contribute in any way or form to the global conversation. And that starts with actively improving our awareness and taking ownership of the situation we have inherited; nobody has any obligation to think on our behalf.

Today, in a capitalistic market, you can outsource pretty much anything. But you can’t outsource thinking. And even if you could, you probably shouldn’t.

References

- Sapiens, Yuval Noah Harari: https://www.ynharari.com/book/sapiens-2/

- The Future of Capitalism, Paul Collier: https://www.amazon.com/Future-Capitalism-Facing-New-Anxieties/dp/0062748653

- ビジネスの未来, 山口周 (The Future of Business, Shu Yamaguchi): https://www.amazon.co.jp/-/en/%E5%B1%B1%E5%8F%A3-%E5%91%A8/dp/4833423936/ref=sr_1_3?dchild=1&qid=1619253042&s=books&sr=1-3

- Capitalism: https://en.wikipedia.org/wiki/Capitalism

- Criticism of Capitalism: https://en.wikipedia.org/wiki/Criticism_of_capitalism

- Capitalism and Inequality: http://www.scielo.br/scielo.php?script=sci_arttext&pid=S0102-69922020000300695

- Neolithic Revolution: https://en.wikipedia.org/wiki/Neolithic_Revolution